My Two Biggest Financial Wins In 2025 | Episode 6

We are in 2026, however I’m going to share my 2 biggest financial wins in 2025 !!

I have been enjoying this journey of documenting the road to financial freedom.

The first big win was selling my condo when I did while the Canadian real estate market was clearly trending downward. The second big win was what that decision allowed me to do—having capital available to invest in the stock market during a period of massive uncertainty. When prices were discounted and sentiment was negative.

So let’s get into it.

Selling my condo while the market was going down

If you live in Canada , you know how emotional real estate is. People don’t just see homes as places to live; they see them as guaranteed investments. Especially if you are a son or daughter on baby boomers. They swear by buying a home.

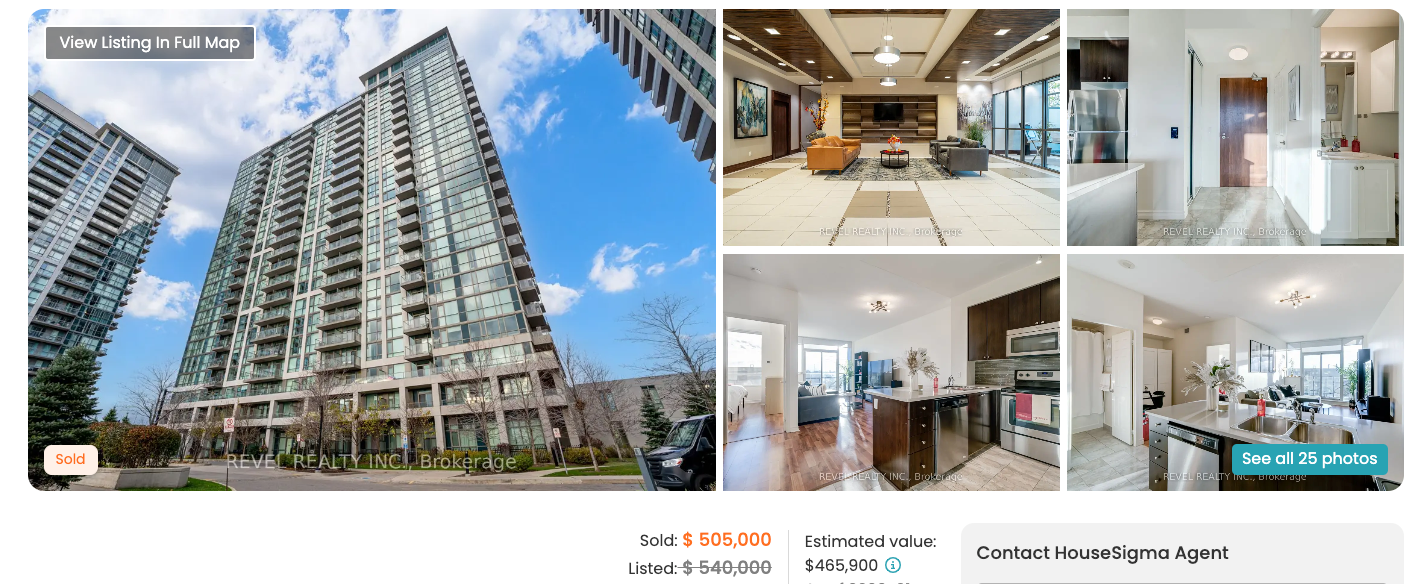

For a little bit of context, I refinanced my condo in December of 2019. I purchased my condo for 300k closed in the summer of 2017. My condo value went at the way up to 520-540k in the open market Till this day I still can’t believe it. The bank did a appraisal on the condo and valued my condo at 480k.

Seeing that I gained so much equity, I pulled some out to purchase a home with my girl at the time now my wife, to buy a home for us to live in and keep the condo as an investment property. I was also invested in the stock as well. My investments valued around 40k at the time

Over the next 5-6 years the real estate market in the GTA took quite a turn.

But by the time I made the decision to sell, the signs were everywhere:

Interest rates had risen aggressively

Buyer demand was slowing –especially for condos

Listings were sitting longer

Price reductions were becoming normal

A lot issues with tenets not paying their rent

The main reason was that my stock portfolio just had much better returns than the condo. It was a simple decision to make

Now here’s the key part—I didn’t sell because I was panicking, I sold because I was being realistic.

By selling, what I did:

I avoided deeper potential price drops

I reduced my exposure to rising carrying costs

I freed myself from a highly illiquid asset.

I sold my condo for 505k but sold to another agent who waived his commission so in real time I sold if for 520k.

Shoutout to my agent Bethany King. She is absolute best of a agent. If it wasn't for her, I don’t even know if my condo would have sold.

I converted uncertainty into liquidity. While others were stressed about mortgage renewals, declining home values, and tightening budgets, I was sitting on capital.

Which leads directly to the second big win.

Investing During Market Uncertainty

2025 was quite interesting. There was a lot of uncertainty in the market large part in due to the Trump tariffs. There was pretty much a new headline everyday talking about economic concerns, increased prices for consumer products. It was a wild time.

n the first week on April the S&P 500 index had dropped to 5,000 from it’s 6100 high in early February– when I say the s&p 500 index I’m just talking about the 500 biggest companies in America. Many people were scared and fearful to see their investments drop so quickly

Fear freezes people - Fear makes people wait for “clarity. - Fear makes people miss discounts while looking for certainty.

Instead, I focused on quality investments and long-term fundamentals.

I was buying while sentiment was negative. I was buying when prices were down—not because I knew the market would recover, but because historically, markets reward patience and discipline.

And sure enough—when the market started to recover, those discounted purchases began to pay off.

Not overnight, not magically, but steadily.

And that's the difference in my opinion between speculation and investing.

Lesson Learned From This Experience

For me this was all about position myself for a better outcome.

I didn’t the stock market would drop so rapidly.

I was investing for a 7 years, saw much better returns with my stock portfolio and the stars just aligned for me.

Looking back, these two financial wins were connected. Selling the condo created liquidity. And having that liquidity I was able to full opportunity was the market was on sale